Integrate Payment Processing with Speedy Client Checkout

Taking payments is a crucial part of any salon business. It may be the best part – this is where your clients reward you for the value you generated and communicated. Now you get remunerated!

The payment services you sign up for in order to be able to accept credit cards in your salon is called a payment processing service. Maybe you obtained your processing services through your local bank as part of setting up your business account, purchased the credit card reader hardware as part of your front desk POS, or opted for mobile reader hardware from a provider like Square.

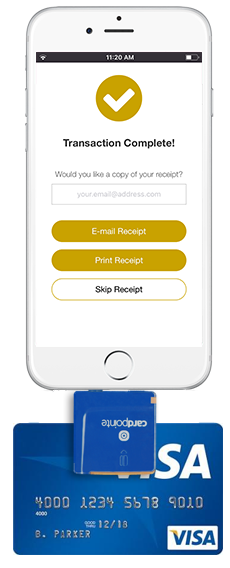

Now, when we say “integration” of a payment processing service, we’re talking about connecting that credit card processing service to your business management software. The salon software tracks your clients and their purchases. When it comes time for a client to pay for services with a credit card, many front desk personnel need to juggle these two systems. The business software provides the total amount due and, if not integrated with your business software, that amount needs to be manually entered into the payment

Hurried receptionists trying to check the client out, maintain some level of cheerful small talk, and rebook or upsell (ignoring the ringing phone) may make mistakes in entering the amount due. So $108.80 might become $10.80. The transaction closes, no one notices the error until a day/week later, and now there is no card to run for the correct amount due.

Aside from making a mistake, operating this way can have other implications as well. Client checkout is the time you should be focused on asking the client about their experience; maybe suggesting re-booking times or product additions. This isn’t the time to be copying data from one system to another, double checking the amounts, and asking the client to authorize the purchase on another machine.

A version of this same scenario, but one in which the payments system is integrated, would save some time for the client and remove the possibility of human error. In the business software, the invoice/ticket shows the amount due and when the client presents a credit card, the card gets swiped on a processing terminal connected to the same PC and the ticket is immediately closed after a successful swipe. Reports in the salon management software are consolidated and correct – no need to reconcile bank statements with other reports to ensure you’ve been paid for every service.

The payment system could suggest tip amounts to the client, adding to your services revenue without having to ask.

Things to keep in mind when choosing the right payment processing services:

Seek a Great Rate

There is money to be saved in every swipe! The variation in rates can sound really small. Really, what’s the difference between 2% and 3% ? Sounds like it isn’t worth the trouble to switch to save a few percentage points or avoid “per transaction” fees. But even for a small volume business, 1% could mean an additional $1,000 or more! It adds up, and it’s all money out of your pocket.

Your Right to Choose

Just because you started the service with your bank or your POS provider doesn’t mean you can’t switch. In fact, there may be some very good reasons to do exactly that and, while preserving profit is always paramount, there are other reasons: state-of-the-art signature capture hardware or merchant portals that let you monitor your activity and access to funds – crucial if you don’t want to wait days to get paid.

Integrating your salon systems isn’t just about simplifying reports for your accountant, or spending more time at checkout focused on people instead of process. Having these two critical business functions side by side makes some other, very interesting, things possible. Namely bringing new, profitable offerings to your salon because you can securely store a credit card number (or token) in your salon software.

One of the most popular is the concept of “memberships.” Now, this might not be right for every salon, but the idea here is that you can offer discounts on products or services for your best customers if they pay every month to get access to a discount on these recurring services (similar to a subscription). So, as an example, a blow drying membership might include “unlimited blow dries” for $300 per month. This presents your clients with an opportunity to get a discount on services they know they like but, in your favor, might not have otherwise obtained that frequently – whether its hair styles or hair coloring. As a salon owner, you’ll reap recurring revenue you might not have had every month as a result.

Yes, you need to be careful constructing memberships so you don’t lose money, and you’ll likely have some people who take full advantage of the membership but there will be plenty of others who don’t. Perhaps even those who give memberships as gifts. Whether this means you get more visits from your best clients or end up collecting money for memberships that get under-used, memberships are a great tool for client retention and represent passive recurring revenue, which can provide crucial cash flow during seasonal downturns.

Besides memberships, integrated payment systems can enable online deposits which, depending on your salon, can be a lifesaver if your clients book appointments online. Having a deposit associated with it will slash your “no show” rates and protect you in cases where people book your time but don’t actually make their appointment.

It’s easy to see that integrating your salon and processing services can save you time, make you money, and allow you to bring exciting new products to your customers, which can strengthen those relationships and secure your revenue streams with new, profitable services.

Integrated payment processing services not only eases reconciliation and reporting, but if you can reduce your rates or get out from under “per transaction” fees, you can save hundreds (even thousands) of dollars each year – money you can use to grow your salon business! There’s no reason to hand over your hard earned profit. Just because you got this equipment from your bank, doesn’t mean they have your best interests at heart. You owe it to yourself to check your rates, and if your credit card processor has been increasing them, providing less than stellar customer service, or making you wait for your money, it might be time for a change.

Contact us at [email protected] and we will get you started on your journey to offering customers new processing services and making more money!